Netflix posted a major earnings beat on Thursday, reporting a 13% jump in revenue for the first quarter of 2025 and showing no signs of being rattled by the tariff-fueled chaos rocking traditional media stocks.

Not only is Netflix raking in revenue—it’s also revamping how you decide what to watch. As part of its forward-looking strategy, the company is testing a new AI-powered search feature in partnership with OpenAI. Dubbed “Netflix AI Search,” the experimental tool is currently being rolled out to iOS users in Australia and New Zealand.

It aims to cut through decision fatigue by serving up recommendations based on your mood, not just genres or titles. Whether you’re craving emotional devastation (Maid, anyone?) or a techno-dystopian spiral (Black Mirror is calling), this new search function taps into the vibe of your viewing habits to help you land the perfect binge.

Combined with a Q2 slate packed with high-profile finales from fan-favorite shows, including Squid Game and Stranger Things, Netflix is betting that smart tech and smarter content timing will keep subscribers engaged—even as it shifts away from transparency on subscriber counts in favor of broader financial metrics.

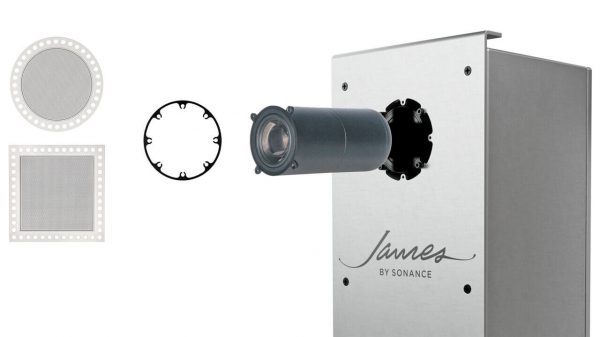

Netflix recently broke ground (local town council approval) on its upcoming East Coast production hub: Netflix Studios Fort Monmouth, right on the Jersey Shore. Yes, the land of Springsteen and saltwater taffy is getting a massive, state-of-the-art studio complex where the next Stranger Things or Beef-style banger could be filmed. I was wise to not sell my home yet as I rebuild in the Sunshine State.

Beat the Street

The streaming behemoth reported $10.54 billion in revenue—slightly ahead of Wall Street’s $10.52 billion estimate—driven by stronger-than-expected subscription and ad revenue. The company’s pricing hike in January likely helped too, with the standard plan now sitting at $17.99/month, ad-supported at $7.99, and the premium tier climbing to $24.99/month. Apparently, viewers didn’t blink.

In a notable strategic shift, Netflix has decided to stop disclosing quarterly subscriber numbers, focusing instead on what it calls “more relevant” performance indicators like revenue and profit. Translation: they’d rather talk about the money rolling in than how many eyeballs are watching.

For the quarter ending March 31, Netflix reported earnings per share of $6.61, blowing past the expected $5.71. Net income came in at $2.89 billion, up from $2.33 billion a year earlier.

Netflix shares rose 4% in extended trading Thursday. And despite the current market uncertainty—largely blamed on President Donald Trump’s latest round of trade policy chaos—Netflix appears unfazed, maintaining its full-year revenue outlook of $43.5 billion to $44.5 billion.

“There’s been no material change to our overall business outlook,” the company said in a statement.

Turns out, when you’ve got global reach, pricing power, and a content library deeper than the Mariana Trench, tariffs just aren’t your problem.

The Bottom Line

While Disney and Warner Bros. are still trying to figure out if people actually want 12 streaming services. Netflix is out here making AI your personal binge buddy and building Hollywood East on the Jersey Shore. With record-breaking Q1 earnings, no subscriber count drama, and a content pipeline that’s hotter than HBO’s budget meetings, Netflix isn’t just surviving the streaming wars—it’s casually bench-pressing them while its rivals fumble for the remote.

Related Articles:

- Netflix Adds HDR10+: Samsung TV Owners Rejoice!

- Netflix Added 19 Million New Subscribers in Q4 2024 and is Rewarding Customers With a Price Increase?

- Does Cutting The Cord Make Sense Financially?

- Netflix AI Search: Because Apparently, the Algorithm That Keeps Recommending Bad Influence Wasn’t Sensitive Enough

Anton Zegler

April 18, 2025 at 2:35 am

Netflix manages to offer content that is either excellent or completely unwatchable.

Fortunately, Prime has some very good shows like the first seasons of Bosch and Bosch: Legacy.

It’s puzzling that they raised their prices and nobody cared. Stock soared today.

Yet other media companies are totally blowing through money and not making a dime.