This isn’t an investment advice column, but maybe it should be. After my recent gloomy—but accurate—prediction about Netflix, someone asked me if I had shorted the stock. No, I didn’t, but that would have been a smart trade. But I hate to make money on someone else’s misfortune.

Which leads me to the subject of Spotify, a business that has delivered plenty of pain and suffering to musicians. And, more recently, to its shareholders.

I want to make some predictions about the future of Spotify, but first let me revisit what I said four years ago, when the company decided to list on the stock exchange. Here are the key points, as I saw them in early 2018.

Not only was the prediction right, but even the timeline. I suggested that Spotify might thrive for another 24-36 months, but the problems would be obvious by that point.

With that prediction in mind, let’s look at what’s happened since Spotify’s listing on the stock exchange. As you can see, the shares hit their peak price at precisely 24-36 months after the IPO—but since that time have collapsed a staggering 70%. The shares are now trading below the original offering price. By comparison, US stocks as a whole are up almost 40% over that same period.

This may be a surprise to some people, but clearly a lot of large shareholders had a hunch that this decline was coming. At the time of the public offering, several large record labels were shareholders of Spotify—but (surprise!) Sony and Warner Music soon dumped most of their shares. Universal Music continues as a shareholder and still owns around 4% of Spotify, but clearly should have sold before the 70% collapse.

I don’t expect Spotify to go bankrupt. Despite my gloomy prognosis, I’ve never predicted that this company will disappear. In a way, that’s a shame. The music ecosystem would probably be better off without Spotify and other predatory streamers.

The problem from the start wasn’t that Spotify isn’t capable of generating cash. Instead the real issue is that streaming will never generate enough cash to make all the stakeholders happy.

The stock market’s negative reaction to the company’s recent quarterly report reflects this painful truth. It’s hard to find new subscribers nowadays, but the real anxiety among investors is the lousy profit margin at Spotify. The gross profit margin was 25.5%—perhaps acceptable for a run-of-the-mill business but disappointing for a dominant tech platform. Even worse, Spotify told investors that they don’t anticipate margin improvement in the current quarter.

By comparison, the gross profit margin at Microsoft is around 70%. The same is true at Pfizer. At Facebook it’s even higher—despite all Mark Zuckerberg’s strategic blunders, the gross profit margin is 80%. Spotify shareholders have been less ambitious, but even they were hoping for a margin in the mid-30s. But with more than 400 million active users, Spotify still can’t pull it off.

The reality is that someone needs to get squeezed for streaming platforms to hit their financial targets—and those cries of anguish you hear from musicians reading their latest royalty statements is what that squeezing sounds like.

The blunt truth is that music streaming isn’t very profitable. And may never be under the current business model.

After all, Spotify needs to pay publishers, composers, record labels, and all its thousands of executives and employees. Then there’s all the other operating costs—rent, computers, bandwidth, etc. Oh, don’t let me forget the musicians—they should get a few crumbs from the table.

But it’s just crumbs. The decision to set a low monthly price for streaming was designed to accelerate adoption, but the cash generated just isn’t enough. And it’s a law of business that the most powerful interests will end up with the lion’s share.

It was obvious from the start that musicians would suffer the most, because they have the least power—and, for the most part, don’t even know what deals have been made between streaming platforms and labels. Of all the stakeholders, they are the most fragmented group, incapable for a variety of reasons of taking genuine collective action. And although their creativity is the original source of all the cash generated by the business, they almost never sit at the bargaining table when deals are done.

So I don’t expect their prospects to improve under the current regime.

Here’s the bottom line on Spotify:

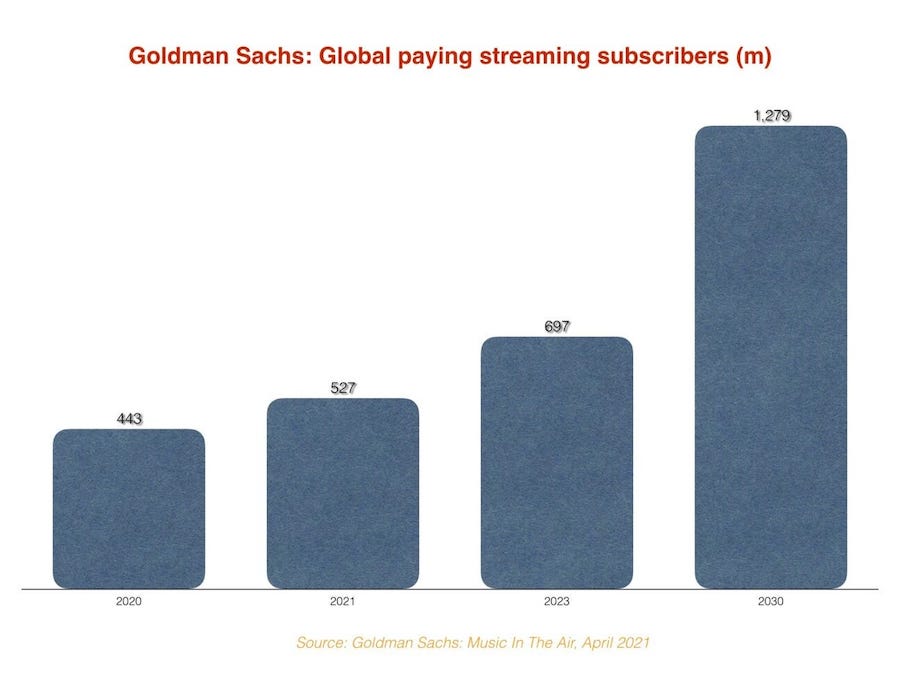

That original pricing strategy (under ten bucks per month for unlimited access) was made in order to shift the market from owning music to streaming it. This was an attractive deal, and it inevitably convinced most fans to give up their physical albums. But from a business perspective, this approach only works if you have the most optimistic—and unrealistic—estimates for subscription numbers. What investors are starting to realize is that projections of that sort are out of touch with the current reality, in which even the most successful platforms may be facing declining user numbers.

Here’s what the New York Times recently wrote on this subject:

“Is there such a thing as too many streaming options? How many people are really willing to pay for them? And could this business be less profitable and far less reliable than what the industry has been doing for years?”

The projections were wrong from the start, in my opinion. The most bizarre fact here is that record labels—historically slow to embrace new technologies—jumped on the streaming bandwagon before it had proven that it could pay all the bills, and still generate reasonable profits.

The music industry acted out of desperation, not wisdom. They had ignored the Internet for years, perhaps hoping it might just go away. But when they learned, to their shock and disappointment, that their usual techniques of litigation, lobbying, and legislation didn’t kill digital music, they started to operate out of fear. They bought into streaming with little idea of where it would lead, or how much cash it would generate.

That was a mistake.

Here are the actual quarterly figures for ‘free cash flow’ at Spotify. You will notice that the numbers have been going in the wrong direction. That shouldn’t be a surprise. When you give people unlimited streaming for less than ten bucks a month, you are operating on a razor thin margin, and unpleasant surprises are likely.

Spotify Quarterly Free Cash Flow

| 2022-06-30 | 64.92 |

| 2022-03-31 | 30.30 |

| 2021-12-31 | 326.54 |

| 2021-09-30 | 204.00 |

| 2021-06-30 | 90.37 |

| 2021-03-31 | 49.43 |

| 2020-12-31 | 206.76 |

| 2020-09-30 | 127.42 |

| 2020-06-30 | 4.40 |

| 2020-03-31 | -23.17 |

| 2019-12-31 | 490.56 |

| 2019-09-30 | 296.90 |

| 2019-06-30 | 249.53 |

| 2019-03-31 | 195.36 |

| 2018-12-31 | 258.64 |

I note that these cash flow figures are in millions, not billions. In other words, for all its size and dominance, Spotify generates less cash than a single hit movie or video game.

I’m not surprised that Spotify has worked so hard to find other sources of growth outside of music. The irony here is that the streaming platforms are the single biggest reason why recorded music is such an ugly investment area right now. That’s why you could have predicted back in 2018 that Spotify would invest in podcasts, and other non-music categories. This also explains why streaming platforms might be so eager to showcase so-called ‘fake artists’—especially if the musicians are willing to give up most or all of their royalties in work-for-hire arrangements.

But no matter what Spotify streams, the company needs subscribers. And the very actions Spotify has taken contribute to consumers’ declining interest in new music. A crappy interface with mediocre audio quality that provides almost no information on musicians will inevitably lead to declining fan loyalty—and so it’s no surprise that, when the economy gets in a tight spot, people cancel music subscriptions.

Spotify’s attempts to channel listeners into music that’s more profitable to them (e.g., work-for-hire tracks from unknown artists) leads to the same end result. This is like the famous table of new books at the front of the Barnes & Noble store—where the company has the choice of displaying the books people will enjoy the most, or instead featuring offerings from publishers willing to pay for placement. Every time a company decides to steer consumers deliberately to inferior products because of behind-the-scenes financial incentives, they undermine their own business model. It may provide a short-term boost but, sooner or later, results in declining customer loyalty.

Where do we go from here?

It may be too late to fix Spotify’s problems. When the company started, it could have pursued a strategy of charging more per month, and offering a higher quality platform—with all the bells and whistles that would get consumers excited about music. That approach would have resulted in a smaller company, but probably a more profitable one—with more money for musicians and other stakeholders. But they took a different path, with a cut-rate option at a cheap price. The inevitable result is that, a decade later, most consumers don’t think music is worth much.

A better solution—which still might happen—is for smart, visionary people who care about music to offer a superior alternative to Spotify. This alternative would earn the loyalty of people who are true music lovers. And there are tens of millions of people like that, maybe even hundreds of millions.

Spotify can be bypassed. A new player could learn from the obvious flaws of their offering, and give us something better. Or more music-focused smaller companies on the current landscape (Bandcamp, Qobuz, Tidal, even a Discogs or CD Baby or a blockchain company) might find a way to take on the big players. The current disillusionment in the financial community with streaming could make that even more likely.

So don’t give up hope. We still could get something better than the current streaming mess. If and when that happens, I will be an early adopter.

Ted Gioia is a leading music writer, and author of eleven books including The History of Jazz and Music: A Subversive History. This article originally appeared on his Substack column and newsletter The Honest Broker.

Related reading: